The post Pursuing Your Passion heads to Byron Bay appeared first on .

]]>An annual event designed to help encourage both men and women to start their own businesses, be inspired in their own established businesses, or follow a creative or career calling, is back in the Byron Shire.

Pursue Your Passion Byron Bay features TV personality Shelley Craft, as well as former Surfing Life and Tracks magazine editor and best-selling surf author Tim Baker, photographer and co-owner of Pampa Victoria Aguirre, and artist and entrepreneur Diana Miller.

Event organisers, co-founders of The Holistic Project (THP), Kristal Brown and Helena Duncan, said in the event’s third year, the diversity of this year’s speakers supported its inclusive nature, open to all people at differing stages of their creative or entrepreneurial journeys.

“This is our first Pursue Your Passion event for both men and women, and it exists for those who are ready to break into their own businesses or new careers, or be motivated to step up the way they are currently doing business,” said Brown. “Led by our incredible MC Shelley Craft, attendees will hear from three inspiring speakers, each well-respected in their fields, as well as enjoy a live musical performance and awesome goodness bags, all in air-conditioned, seated comfort. It’s also a great forum for these likeminded people to connect and encourage each other to be confident in their abilities, create the balance they need in order for a start-up to work, and explore opportunities for collaboration.”

Duncan said the traditionally sold-out event would feature some big take-home tips and a Q&A session with its key speakers, as well as involvement from some highly influential health and lifestyle brands.

“We are very fortunate to be hearing from some of Australia’s biggest success stories across three creative disciplines – all sharing stories from their unique experiences in business and career, as well as bringing their wonderful grounded natures to each of their talks,” she said.

“Topics covered will include take-home tips on how to create a sustainable lifestyle from following your passions, how to create with purpose, and how to balance the busy demands of a creative career.

“The positive and uplifting nature of the event has attracted several lifestyle sponsors, as well as a proud partnership with mental illness and suicide awareness charity LIVIN.”

Pursue Your Passion Byron Bay is on Saturday, 18 February from 2.30-5.30pm at The Byron Theatre, Jonson Street, Byron Bay, and is proudly sponsored by The Event Shed.

Tickets are $99 and are strictly limited. For tickets and more information visit www.theholisticproject.com.au or contact the Byron Theatre box office direct on (02) 66 856 807.

Caption: Founders of The Holistic Project Helena Duncan and Kristal Brown are bringing inspirational event Pursue Your Passion to Byron Theatre on February 18, featuring some of Australia’s most inspirational creatives.

The post Pursuing Your Passion heads to Byron Bay appeared first on .

]]>The post Campbell Korff’s crusade against credit cards appeared first on .

]]>This Christmas I’m declaring a crusade against the credit card. I’ve had enough. Together with gambling, they’re a financial cancer eroding our national wealth. According to ASIC, we all owe the banks and other credit card issuers a total of around $31 billion. No, I’m not kidding.

Regular readers will recall my, now somewhat prescient, article in May 2015 on the Australian banks and the increasing pressures on their business model of borrowing short-term funds and lending (mostly home loans) for the long term. As I predicted, those pressures have negatively impacted their share price.

Well, no such pressures exist for credit cards. Despite record low interest rates, credit card rates have remained incredibly high. According to the RBA, the average cost of funds (interest rate at which they borrow) for the major banks is approximately 2.3%. While the average credit card rate is around 19%. That’s a profit margin of over 700%!

Yes, I know, there are 55 day interest free cards and others that give people the ability to better manage their cashflows, as long as they pay off the balance within 55days. Well, here’s the thing: the banks don’t issue these cards out of the kindness of their hearts. They issue them knowing that nearly all of us will regularly miss the interest free deadline and pay the ruinous interest and fees.

Canstar estimates that in the last four years we all paid a total of $35billion in credit card interest. That’s enough to pay off a quarter of the nation’s mortgages. What’s most frustrating about these statistics is that they are totally avoidable. Thanks to EFTPOS, debit cards and pre-paid travel cards, there is absolutely no need whatsoever to own a credit card. That’s right. No need whatsoever.

Many will argue that they need them to manage their cashflows each month. I can show you a far more effective tool that doesn’t cost you thousands of dollars each year: it’s called a budget and savings plan. All it takes is a little will power and patience and you will start growing your wealth, instead of destroying it.

If you don’t feel you can do this on your own, then drop me an email and I will show how to get off the credit card drug in months. No fee. No obligation. It will just make me feel good that my crusade has cancelled one credit card.

So go get the scissors out and start cutting up those cards before the financial cancer does any more damage to your wealth.

Contact Campbell Korff at Ballina Yellow Brick Road on: [email protected]

The post Campbell Korff’s crusade against credit cards appeared first on .

]]>The post Thinking outside the box – pricing for success appeared first on .

]]>Last week I was reviewing a client’s investment property portfolio and I was able to convince him that taking his negatively geared portfolio into retirement didn’t make a lot of sense and that it was time to shed one of them, so that the portfolio became positively geared.

I asked him what he would be willing to sell it for. Performing some mental arithmetic, starting with his purchase price and adding stamp duty, legal fees, rates and taxes and renovation expenses, he replied: “Well it owes me $750K, so around $900K seems right.”

While this seems compelling logic, it has nothing whatsoever to do with what his property is actually worth. His property is, of course, worth what the market is willing to pay him for it. His ‘sunk costs’ are irrelevant.

This cost-plus pricing fallacy is surprisingly common among both investors and businesses. A business owner making widgets might design Widget MkII, calculate its average cost of production, add his target margin and take it to market. Seems prudent, right? Wrong. The problem is that this ignores the impact of price on volume and volume on costs. A price increase to “cover” increased costs can start a death spiral in which higher prices reduce volumes and increase average unit costs even further, indicating (according to cost-plus logic) that prices should be raised again!

In simple terms, the cost to produce a widget is made up of fixed and variable costs. Instead of asking what price will cover total unit costs, the business owner should ask whether the change in price will result in an increase in revenue which is more than https://www.cialisgeneriquefr24.com/le-prix-de-cialis/ the variable costs of making the extra widgets (e.g labour, materials etc.). If the answer is yes, then the surplus is reducing fixed costs per widget and making the business more profitable.

Pricing is complex and dynamic and should be approached strategically and pro-actively as market circumstances change. Almost every modern household name you cialis tadalafil prix can think of (Apple, Netflix, Virgin, Aldi etc.) have been prepared to think outside the box on pricing and have profited by challenging the perceived wisdom. A good starting point, is to focus on what the customer is willing to pay (this can be improved with marketing, of course) and work backwards to production cost. When doing so, consider which fixed costs are sunk and, therefore, irrelevant to pricing. It’s pricing above the marginal cost of the next widget produced that counts.

Whether that’s a widget or an investment property, strategic pricing will result in higher profits. Email me at [email protected] if you would like more information.

The post Thinking outside the box – pricing for success appeared first on .

]]>The post Mark Bouris: Ten things young investors should know appeared first on .

]]>By the time you’re employed and receiving superannuation, you have an opportunity to invest for your future. It can be confusing and it shouldn’t be. So here’s 10 basics investment principles for those aged 30 and under.

Time: time is your second-greatest asset, after the ability to generate income. Time drives the compound effect, where returns on your assets are added-in to your lump sum. $1,000 that’s earning five per cent p.a. doubles in fourteen years thanks to compounding. If you’re a 25 year-old woman, you have another 70 years of living and letting compound interest work its magic.

Investment: don’t confuse investment with saving. Investment is developing an appreciating asset in the long term so it eventually generates income. Saving is accumulating cash for short-term goals such as house deposit, holiday, car and university fees.

Risk-Return: investing is a trade-off between risk and return, so to get high returns you take more risk (of the value going up and down) in assets such as shares. To ensure your returns, you have to stay invested for the long term.

Risk profile: the most important aspect of your profile is age. In your age group you have many decades to weather the ups and downs of share markets, so you enjoy the gains. Your greatest risk is probably inflation, which reduces the spending power of your cash by around 2.5 per cent each year.

Superannuation: super is not an asset class – it’s a tax-friendly investment vehicle that will deliver an income for you in your post-working years. Make sure you’re invested in super fund options that give you the best chance of building a large nest egg.

Property: if you can’t buy where you want to live, buy an affordable investment property and ensure it yields capital growth and income. There are tax-planning factors in property so model the investment with an accountant.

Goal: always create your own goals. It makes it easier to find the products, solutions and strategies relevant to you.

Advice: you don’t necessarily need full financial planning to gain expert insight. Some advisers will deal with you on an hourly basis and your super fund fees might include advice – use it!

Help: you don’t have to know everything. Try online apps such as Acorns and Self Wealth, which have smart options, at low cost without too much detail. To invest in shares without expertise, you can ‘buy’ the market: managers have funds that track stock exchange indices and you can buy exchange-traded funds (ETFs) that track indices of major stocks, such as the S&P ASX200.

Diversify: don’t place all your wealth in one asset, one asset class or one industry. Don’t overweigh yourself with for instance property, or mining shares – concentrated portfolios can fall faster and take longer to recover.

Finally, never take your eyes off inflation – the quiet destroyer. You can overcome the ‘risk’ of shares going up and down, by using time. But if you become too conservative and put all your money in cash, time allows inflation to win.

For more information on Yellow Brick Road, go to: https://www.youtube.com/watch?v=0K0C2F_DJLE

The post Mark Bouris: Ten things young investors should know appeared first on .

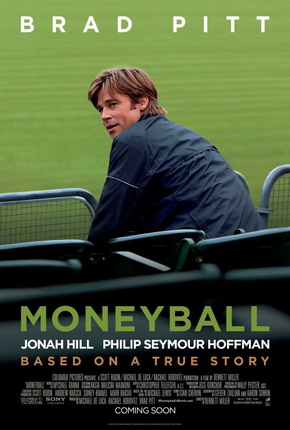

]]>The post The movie Moneyball is right on the money… appeared first on .

]]>I love this movie. This American biographical sports drama from 2011, which is based on a true story, is smart, relevant and it explains a concept not many people can pull off – for so many reasons. It takes bravery, intelligence, the understanding of theoretical insights, and a unique ability to build application of these insights, when everyone else is playing the game the same way and telling you that is how you have to keep playing it. It takes jumping off the edge and bucking the system, despite all the odds, because you know you can never win in an unfair environment when the competition has more money than you, and can always outspend you, and buy the resources they need to keep winning. So why do you keep playing the old way?

If you haven’t seen Moneyball the movie see it get it out or download it as soon as you can. Why? Because Moneyball shows exactly what most businesses are trying to do today and why they are not succeeding. If you ‘get’ this movie you will immediately understand the power of behavioural economics (B.E.) on your business – even if you don’t know what B.E. is yet.

Brad Pitt plays the Oakland A’s general manager, Billy Beane. In this real life story he changes the game by hiring an outside Yale-educated economist who looks at baseball differently. It’s about buying wins not players.

Most businesses today are asking the wrong questions.

What’s the problem? Are you even looking at the problem? While you are busy solving the wrong problem and investing resources, over and over again to do so, you might want to start tomorrow differently. Instead, tomorrow ask yourself two different questions:

Q1: What behaviour are we trying to change?

Don’t be stunned if this takes you hours to truly identify. Yes, I’ve been in management meetings where we have spent nearly two hours trying to understand and agree on the actual customer behaviours we are trying to change.

Q2: How do we disrupt it?

To disrupt behaviour requires something so powerful it interrupts the customers default behaviour. Because status quo is always the first choice option. Let’s face it, if you’re not #1 then the default is to NOT buy your product. If you’re too scared to admit the truth that customers are walking away from your brand and buying the competition, you’re spending money in the wrong direction.

The Oakland A’s won exactly as many wins as the New York Yankees. But the NYY’s spent $1.4M per win and OA’s spent $260K. Billy Beane forever changed the way baseball was played.

Yes, change threatens the game, livelihoods, the market, the competition and yes the scariest of all – people’s jobs (including your own). However without it you’re losing anyway. So why not give it a try?

Today, it’s about outsmarting not outspending your competition. When are you going to begin?

Sonia Friedrich is a Strategic Consultant and runs the 3-Day Academy:

It’s a NO BRAINER! – Behavioural Economics in Business.

Each Academy is limited to 15 people.

OR contact Sonia to organise a Private Academy dedicated to changing the game in your business.

Call today 0412359424 or e-mail [email protected]

The post The movie Moneyball is right on the money… appeared first on .

]]>The post Julie Ann Cairns – Cracking the Abundance Code appeared first on .

]]>Verandah Magazine has FIVE copies of The Abundance Code to give away – simply leave a comment in the FB box at the bottom of the story, or on Verandah Magazine’s Facebook page, saying why you would like to win a copy.

How is Abundance like a Tree?

They say that money doesn’t grow on trees. Which I always think is funny, because in most countries money is printed on paper, and that does actually grow on trees! Or at least it’s made of trees…

For me, trees have taught me three big lessons about abundance.

Abundance Tree Lesson #1: A Hollow Tree is NOT a Healthy Tree

Years ago I was quite fixated on gaining material success. I worked hard at school, I won scholarships, I spent many years at university and learned about economics, and statistics, and the intricacies of trading global financial markets. I worked at a merchant bank. I discovered many secrets about how and why money flows around the world the way that it does. And I learned how I could position myself to catch some of that flow.

But here is a good question to ask: Why? Why did I want material success so badly?

It’s not a stunningly obvious question… I mean who doesn’t want it? Don’t we all? Do I even need to be asking that?

Maybe.

In my mind, I thought money would solve all my problems. I thought I would get the fine house, and the sexy car, and the walk-in closet full of high, high heels that would go ‘click click click’ when I walked down my long, sundrenched hallway, past huge panes of glass, and out to my sparkling pool… and everything would be perfect. Just perfect.

I imagined that once I had all those things, everything in my life would feel beautiful on the inside too. Like the pages of an interior design magazine. And until I had attained that dream, if I didn’t feel so fantastic on the inside… well, I could easily explain that to myself. I simply wasn’t there yet.

And then one day, I arrived.

I got the house. I got the car. I got the shoes. I even got a handsome and successful husband, and we had a gorgeous little girl. Everything on the outside was beautiful and perfect. So why didn’t it feel that way on the inside?

Ever heard that saying: “wherever you go, there you are?”

I was still me, with all my old issues and insecurities. An annoying tendency to dip into depression still clung to me. I don’t mean to belittle depression, believe me. But the fact that I was prone to it did annoy me. It didn’t fit with my ideal of the perfect life. And perhaps that meant that I didn’t fit in to the ideal either.

No matter how much my perfect life tried to convince me, I knew nothing had really changed. Not in a way that mattered. Not inside. Maybe I could fool everyone else, but not myself.

I felt hollow. And if I was honest, I had felt hollow for almost as long as I could remember… something deep inside me was shut down. And that made even the most stunning successes in my life feel empty. Everything tasted like dry toast.

Wow. Do I sound like a brat, or what? Because OH! The outside of my life was so glorious! Where is the gratitude for that? And yet, the outside did not match the inside. So I guess something had to give.

Maybe I even conspired with my own subconscious, or the universe, or whatever, to set that straight. To even things up. To strip material success and glory from my life so that the outer would match the inner once again.

Before long, I had travelled to the brink of bankruptcy. My daughter had gotten sick and nearly died. My handsome and wonderful husband, who happened to be transgendered, decided that he wanted to become a woman and someone was trying to blackmail us about that.

Oh yes, it all began unravelling. And fast.

The hollow tree of my life was collapsing in on itself.

Abundance Tree Lesson #2: Water the Roots, Not the Leaves

The epiphany came for me when I realised that I was recreating a version my childhood experience all over again.

My parents, like me, had achieved an amazing level of success and wealth pretty early in life. By about the age of 40. They had worked hard for it, and like me, they’d probably thought it was going to be the ‘answer’.

Then, when they’d achieved all their goals – the architect designed house on the shores of a beautiful lake in Canada, their own private airplanes, an art collection, a constant stream of fabulous parties full of beautiful people – they too discovered an inconvenient truth. They still were not happy.

That’s when their drinking really escalated. That’s when they began to take it all apart – piece by piece, screaming fight by screaming fight – until nothing was left. When I was 11 they divorced. My father retreated to Australia, and moved in with his brother. My mother declared bankruptcy. There’s a lot more to this story, but suffice it to say that I saw too much alcohol-induced craziness to come out with my childhood innocence intact. Something deep within me had died.

Later, as I faced my own possible bankruptcy, also at around the age of 40… and the dissolution of my marriage, blackmail, and the stress of my daughter’s health crisis… it struck me how my life was playing out in a way that was eerily similar to the story my parents had modelled for me. I had somehow recreated the same glorious heights of success, the same experience of emptiness… and I knew that if I let that story continue to unfold according to the ‘script’ then what came next was going to be a spectacular train wreck.

How could I stop it?

It suddenly became apparent to me. A blinding flash of the obvious. I saw the connection between my deepest beliefs – about myself, about money, about success and how it relates to happiness – and my own outcomes in life.

If the roots of my situation lay in my childhood programming, it meant that if I wanted to change my situation, I needed to make a change at that level of programming. At the level of my beliefs. I could still have a successful and beautiful life… but I had learned a truth. The inner and the outer must match.

I had always used knowledge and effort as the means to gain success, but that was like watering the leaves of my tree of abundance. And that’s what a lot of people do. Go out and get qualifications, work hard, and do lots of tangible actions in order to get what you want. And that’s not a waste of time. Education is important. Action must be taken. But when the roots of the tree are unstable, watering the leaves is not going to make a much of a difference. It will fall over anyway.

I saw that it was my underlying belief blockages and limitations, my faulty subconscious programming, which had undone all the benefits I’d gained from extensive knowledge and action. You might look at my story and say it was not my fault. I might not have chosen my daughter’s health crisis, but I had chosen my husband, and together we had made some unfortunate decisions in our business. That’s the thing about the way our subconscious minds work – our underlying programming affects a million little choices and decisions that all add up to us playing out the exact script of our beliefs.

The roots of my tree (my beliefs) were unstable, and that’s what needed to change. I needed to heal the part of me that was shut down and hollow, and I needed to water and tend to the roots.

Abundance Tree Lesson #3: Don’t Be a Bonsai

When the roots of our tree of abundance are deformed, or limited, or not supportive of our conscious goals in life then our tree’s growth will be stunted. Just like a Bonsai tree is stunted. Because a Bonsai tree is just a normal tree that has been put into a tiny little pot so that it becomes root bound. In that condition it can never reach its full potential. It stays small.

We are like that. Ultimately it’s our limiting beliefs that thwart, or undo, our best efforts to succeed. And that keeps us small.

Don’t be a Bonsai.

It takes some effort to dig in and uncover your limiting beliefs. It also takes some effort to over-write them with beliefs that do not limit you. But it’s easier than you think, and so worth it.

When I over-wrote my limiting beliefs, I was able to change the trajectory of my story. We managed to avoid bankruptcy and go on to rebuild even greater financial success than before. We have a business that teaches people how to trade financial markets, and we came out with a new and innovative product in the business that turned out to be a great success. We went from being millions of dollars in debt and on the brink of insolvency, to debt-free with millions of dollars in the bank within 4 short years. And this was all achieved during unfavourable economic conditions, in the 4 years following the Global Financial Crisis when the Australian economy teetered on the edge of recession and many of our competitors went out of business. Beliefs are powerful things!

Once I changed my limiting beliefs, I was literally able to see opportunities that had very much been right in front of my nose all along… but I had just been too blinkered and stressed out to see them. Changing my beliefs changed the way I saw the world, and that in turn changed my experience of the world.

Other areas of my life transformed as well. My husband did become a woman, which I now believe was the best thing could do for his happiness. He is now a she – a beautiful woman who is still my best friend. And, thank God, my daughter recovered and is now growing into a beautiful young woman herself.

I documented the process I went through in order to over-write my beliefs, to lovingly nourish and tend to the roots of my tree of abundance, in a book called The Abundance Code.

My tree of abundance is no longer a Bonsai. It’s big and strong. The roots are healthy, stable and deep. Yours can be too.

Julie Ann Cairns is a former Reserve Bank of Australia and Macquarie Bank economist and financial markets analyst, and is currently the Managing Director of financial markets education company Trading Pursuits Group, based in Sydney Australia. In this spirit, she wrote The Abundance Code: How to Bust The 7 Money Myths For A Rich Life Now (Hay House, September 2015), and has spearheaded The Abundance Code Documentary (scheduled for release in June 2016) to help people everywhere make a shift to the abundance mindset and seek joint solutions to the most pressing challenges facing our planet.

For more information on The Abundance Code go to: theabundancecodebook

The post Julie Ann Cairns – Cracking the Abundance Code appeared first on .

]]>The post Businesses have 30 days left to apply for the R&D tax incentive appeared first on .

]]>If I said I can help you increase your revenue by 45% would you want to know how?

It’s not quite revenue, however it is $$$. For many businesses that invest in their own R&D, the Australian Government offers a 45% rebate through the R&D Tax Incentive. Not bad! Don’t you think it would be silly to miss out? Not only that, if you do qualify, you are guaranteed for the next 5 years.

Yes it can feel like another chore. So let’s get that out of the way too. Just like you hire your accountant to do your tax, there are specialised accountants for R&D submission – experts in their field who understand the application process like the back of their hand. I know one in particular with a 97% success rate, (if you meet the qualifying criteria)…AND in nearly all cases he only takes a 10% success fee. If you want to know more, seriously, ask me. I will connect you both (he has asked I do not publish his name for fear of being inundated).

Yet time is running out. Your application needs to be in by April 30th, 2016 and there is a little work to get together for it to be submitted. You can visit the website for more details:

Here are six pointers to check off to get you started:

- A company must have R&D deductions for an income year of at least $20,000 in order to claim a R&D Tax offset

- Companies may receive a 45% refundable tax offset if their turnover is less than $20 million.

- Companies may receive a 40% refundable tax offset if their turnover is more than $20 million.

- Generally a company that pays tax in Australia and is incorporated under Australian law is eligible

- Core R&D activities are the part of the work where the company tries to do or make something that hasn’t been done before and cannot be done without experimenting.

To prove it, the company must aim to create new knowledge by following a path from concept to conclusion with measurable experimental outcomes to support the reasons for the conclusion.

Core R&D activities could be, for example, the testing of a new or improved product, device, process or service

- Yes you need to have kept records too. Either activity based record keeping or expenditure based.

If you have all of the above, I suggest you make contact and don’t miss what really is a no brainer for you and your company. hand the application over to an expert who can remove the headaches for you.

Grant writing is an artform…hire a qualified artist!

Sonia Friedrich has been called a Growth Hacker. She is a Mentor, Strategic Consultant, Speaker and Author. She works with CEO’s, Entrepreneurs, Start-ups, Executive Directors, Marketing & Sales Management, Advertising and Communications Agencies (on-land and on-line), and anyone wanting to propel themselves forward. She works with small business to multi-nationals, across all sectors.

Sonia’s purpose is to empower others in business and in life. She adds insight from behavioural economics (BE) and neuroscience to all business and marketing challenges. She has worked with Fortune 500 companies building brands up to $250 million in Australia and New Zealand. She was the General Manager of Grey Healthcare Advertising in Sydney. Sonia lives in Byron Bay and attracts clients to Byron Bay for speaking events, conferences and intensives.

To find out more, call Sonia.

Contact: sonia@soniafriedrich.com or 0412 359 424 or go to: soniafriedrich.com

The post Businesses have 30 days left to apply for the R&D tax incentive appeared first on .

]]>The post Campbell Korff on why it pays to have your glass half full.. appeared first on .

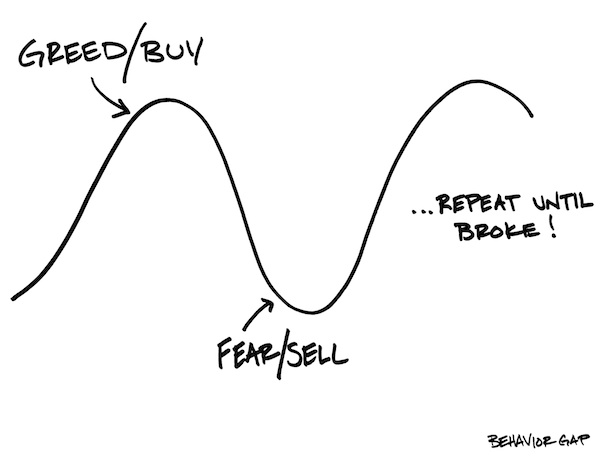

]]>It’s a well known face that we fear loss two to three times more than we enjoy gains. This psychology explains a lot of our behaviour in everyday life. Indeed, it has been critical to our survival for thousands of years.

Risk aversion can be very important when hunting for food in foreign environments, constructing a dwelling and caring for our young. However, when it comes to investing in the modern world it can lead to chronic underperformance. Here are a few reasons why:

Procrastination – fear of loss causes us to put off financial decisions in the hope tomorrow will be a better day. The problem for pessimists is that day may never come or be so delayed that more damage is done by leaving their capital on the sidelines.

Financial media – if we all felt great about the economy and our financial security we would never pick up a financial newspaper or watch the finance news each night. Our inherent financial insecurity has created a multi-billion dollar industry expert at exaggerating the most obscure financial data so long as it feeds our inherent belief that the financial world might just end tomorrow and send us all bankrupt.

Ignoring the facts – it is a fact that the Australian stock market has delivered average returns in the high single digits for over a century. It is also a fact that over this period only around 1 in 5 years produced negative returns. If you invested $10,000 in the Australian Stock Market in 1980 and re-invested the dividends, these facts would deliver you an investment worth around $850,000 today. You don’t believe me, do you? Our fear of loss causes us to discount positive data even when we know it’s true.

Short term thinking – we invest our savings across our entire adult lives. For most of us, this is a 60 to 70 year timeframe. Yet how often do we make decisions based on short term data? The Australian stock market is down around 15% since April, which is not good news if you need to sell your entire share portfolio tomorrow. If you don’t, history indicates it is more probably a time to think about investing more.

Compounding losses – there’s only one thing worse than losing money; that’s throwing good money after bad! Even when we know we have made a bad financial decision, we often stick our head in the sand in the hope the losses will miraculously disappear, rather than exit and stop the bleeding. Everyone makes mistakes. Face them, learn from them and move on.

Our fear of loss is instinctive, which makes it very hard to displace. However, to be successful investors we must be aware of how it can cloud our judgment and filter out information which is designed to accentuate this fear, rather than help us make good investment decisions.

If you would like to contact Campbell Korff of Yellow Brick Road Ballina go to: www.ybr.com.au/Branches/Ballina

The post Campbell Korff on why it pays to have your glass half full.. appeared first on .

]]>The post Global Entrepreneurship Mixes With Local Creativity appeared first on .

]]>There comes a time in every budding entrepreneur’s life when they need to expose that deep dark ‘brilliant’ idea to the light and glare of the public. And one of the best means for doing that in an age of global sharing and collaboration is through events developed specifically for the task – Startup Weekends.

Startup Weekends bring together ideas and people who can act on ideas in a way that quickly tests and validates your dream within 54 hours. They do it at far less cost, time and personal angst than anyone can do alone. In a room of hipsters, hackers and hustlers you will articulate, refine, test and validate your idea in super-quick time.

And you can win prizes and enormous glory while you do it.

Startup Weekend Byron Bay kicks off on Friday November 20th and finishes on Sunday 22nd. It is cohosted by SAE Creative Media Institute Byron Bay and StartInno in the Ewingsdale Road Campus and Byron Bay Arts and Industrial Estate respectively.

The weekend is part of Global Startup Battle 2015 which means local creatives and entrepreneurs will be joining of thousands of others from across the globe for one of the most innovative weekends of the year. Byron Bay will be one of the 250 cities competing to celebrate Global Entrepreneurship Week.

It;s not all about tech either. Technology is often a driver and enabler of change but good ideas must also satisfy business needs and provide a purpose that compels a customer to take up the product or service. Hence rounding out your idea in a broad forum is critical to developing its validity. Startup Weekends around the world have brought together designers, creatives or anyone with business ideas together with tech to produce amazing things! Dr Dan Swan, lead organiser of Startup Weekend Byron Bay and Founder of Byron Bay’s startup innovation and coworking hub, StartInno, says: “Take artists and designers, they do what they do because it comes naturally, commerce however is another challenge. The same can be said for Tech. The growth in startups mean that commerce is no longer the domain of spreadsheets and beancounters, it’s a creative process in itself. Startup Weekends help people who previously weren’t able, become startup entrepreneurs instead of leaving vital decisions to others.”

So whether you have new ideas or just want to see and hear the latest in innovation go to Startup Weekend Byron Bay and grab a ticket for what is shaping up to be a great weekend

For more information or to contact the organisers: https://www.startinno.com/events/startupweekend-byronbay

[email protected] @startupbyron #startupbyron

The post Global Entrepreneurship Mixes With Local Creativity appeared first on .

]]>The post Win $5000 and a mentoring session with Mark Bouris appeared first on .

]]>

Verandah Promotion

Do you want to meet renowned Australian businessman, media personality, chairman of Yellow Brick Road, and this seasons host of Celebrity Apprentice, Mark Bouris?

Yellow Brick Road Ballina are offering you the chance to meet with Mark Bouris for a one hour mentoring session where you can get Mark’s personal insights into being successful. They are also throwing in a hefty $5,000*

For your chance to win, register with Mark’s trusted advisers at Yellow Brick Road Ballina for an obligation-free 15 minute financial health check.

In your financial health check, your advisor will look at what your financial goals are, where you are now and help to start you on your journey to a secure financial future.

Contact our Ballina branch on 02 6686 6678 for your obligation-free health check and we can get you started on your path to financial freedom.

* Competition Terms and Conditions apply. Credit services provided by Yellow Brick Road Finance Pty Limited ACN 128 708 109, Australian Credit Licence 393195. Financial Planning services provided by Yellow Brick Road Wealth Management Pty Limited ACN 128 650 037, AFSL 323825.

The post Win $5000 and a mentoring session with Mark Bouris appeared first on .

]]>

![StartupWeekendFlyer_A4[1]](https://www.verandahmagazine.com.au/wp-content/uploads/2015/11/StartupWeekendFlyer_A412-682x1024.jpg)