The post A fundamental financial fact – time is money appeared first on .

]]>If there is one concept of finance and investing which is at the same time the most important and the least understood, it would have to be the time value of money. It’s the fundamental building block that the entire field of finance is built upon. And yet, many people lack a solid understanding of how it works.

Time value of money is the economic principal that a dollar received today has greater value than a dollar received in the future. If you were given the choice between receiving $100 today or $100 in 10 years, which option would you take? Clearly the first option is more valuable because of:

Risk – There is no risk of getting money back that you have today.

Purchasing Power – Because of inflation, $100 can buy more Mars bars today than it will in 10 years; and

Opportunity Cost – a dollar received today can be invested now and earn interest. However, a dollar received in the future cannot begin earning interest until it is received. This lost opportunity to earn interest is the opportunity cost.

All time value of money problems are solved using two fundamental calculations: compounding and discounting.

Compounding is the process of determining the future value of an investment made today and/or a series of regular payments.

Most people understand the concept of compound growth. If you invest $100 today and earn 10% interest for two years, your initial investment will grow to $121 at the end of year 2. The initial $100 compounds because it earns interest on the principal invested, plus it also earns interest on the interest.

Discounting is the process of working out the value in today’s dollars of money to be received in the future, as a lump sum and/or as regular payments, by applying a discount rate. The discount rate is the required rate of return or opportunity cost of an alternative investment.

It is impossible to make a sound investment decision without using these calculations, yet few do so accurately.

To illustrate with a simplified example, if a property you want to buy is worth $500,000 today and you require a 10% return, assuming you hold it for 10 years and receive a yield of 2% after all expenses, you would need to sell it for around $1.1m in 2025. To help work out if that is realistic, you could discount back from today’s value to 2005 at the same rate of return and compare it to sales prices at that time.

There are obviously a lot of other variables to consider, so, as always, see a professional before you invest. It could save you thousands.

If you would like to learn more about prudent investing, please send me an email or drop in for a chat.

If you would like to contact Campbell Korff of Yellow Brick Road Ballina go to: www.ybr.com.au/Branches/Ballina

The post A fundamental financial fact – time is money appeared first on .

]]>The post Mark Bouris: Structuring your super for success appeared first on .

]]>

It’s a good time to remind ourselves that superannuation is not an investment – super is a tax and legal structure to create an income in your retirement.

Superannuation is a government regulated way to boost long term savings with generous tax concessions, as the mainstay of your retirement nest egg alongside your home. Your employer has to contribute 9.5 per cent of your wages into a complying super fund, and these contributions are taxed at 15 per cent, not the usually much higher marginal tax rate of your wages.

Once this money is in your account the earnings from the investment is taxed an average of 8 per cent. When you retire and draw down your lump sum, you pay zero tax on any earnings your investments then produce – another great benefit.

The price for all this is that once your money is in super, it is there until you retire.

The performance of your super really depends on the types of things (asset classes) you are invested in.

Growth assets like shares and property are more likely to produce shorter term fluctuations in their price. History has shown that shares have performed in this group over the past 100 years. But to get these returns you must invest for at least 10 years to weather the volatility they can create. This requires discipline, calmness and the ability to stay focused on the long term result above the noise of today.

At the other end of the spectrum, putting your money in cash is a more stable. But when interest rates are low – as they are now – you risk losing your earnings to inflation. Generally you need to aim to produce an overall return from your super after tax and fees that is two per cent to four per cent a year better than inflation to enjoy a decent retirement. Adding in more than the regulated 9.5 per cent of wages is also required.

In between cash and equities, there are fixed interest investments such as government, corporate debt and property. They are more volatile than cash but don’t have the same returns as shares.

Where should your super be invested? Match your planned retirement length to the asset classes that will produce enough income for that time. For a 65 year old today this is at least 20 years. In the past, people would switch to cash or fixed interest from any growth investments they held which is seemingly prudent but it is very dangerous as it maximises the impact of your number one risk. That risk is that you run out of money too early or have to live on much less than you would like.

A better way is to simply place one to two years of income into cash and bonds in a separate account. This means you have immediate living expenses covered for a few years, while your nest egg is growing and the price moves around in the short term.

The main point to remember as the super statements arrive: Super is not the investment, but you can actively manage your investment options within super to ensure you gain the best returns commensurate with your timelines.

If you would like to contact Campbell Korff of Yellow Brick Road Ballina go to: www.ybr.com.au/Branches/Ballina

The post Mark Bouris: Structuring your super for success appeared first on .

]]>The post Campbell Korff on why it pays to have your glass half full.. appeared first on .

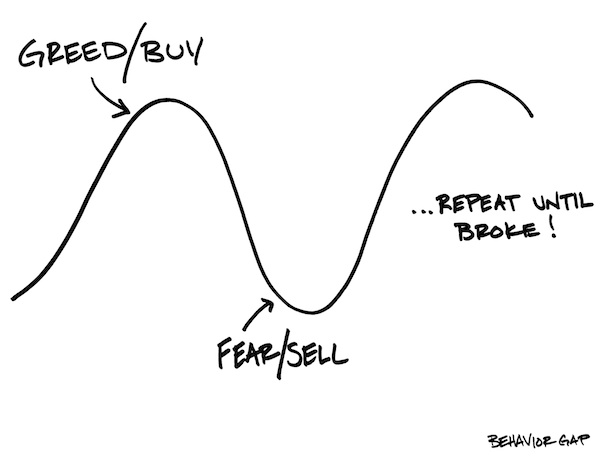

]]>It’s a well known face that we fear loss two to three times more than we enjoy gains. This psychology explains a lot of our behaviour in everyday life. Indeed, it has been critical to our survival for thousands of years.

Risk aversion can be very important when hunting for food in foreign environments, constructing a dwelling and caring for our young. However, when it comes to investing in the modern world it can lead to chronic underperformance. Here are a few reasons why:

Procrastination – fear of loss causes us to put off financial decisions in the hope tomorrow will be a better day. The problem for pessimists is that day may never come or be so delayed that more damage is done by leaving their capital on the sidelines.

Financial media – if we all felt great about the economy and our financial security we would never pick up a financial newspaper or watch the finance news each night. Our inherent financial insecurity has created a multi-billion dollar industry expert at exaggerating the most obscure financial data so long as it feeds our inherent belief that the financial world might just end tomorrow and send us all bankrupt.

Ignoring the facts – it is a fact that the Australian stock market has delivered average returns in the high single digits for over a century. It is also a fact that over this period only around 1 in 5 years produced negative returns. If you invested $10,000 in the Australian Stock Market in 1980 and re-invested the dividends, these facts would deliver you an investment worth around $850,000 today. You don’t believe me, do you? Our fear of loss causes us to discount positive data even when we know it’s true.

Short term thinking – we invest our savings across our entire adult lives. For most of us, this is a 60 to 70 year timeframe. Yet how often do we make decisions based on short term data? The Australian stock market is down around 15% since April, which is not good news if you need to sell your entire share portfolio tomorrow. If you don’t, history indicates it is more probably a time to think about investing more.

Compounding losses – there’s only one thing worse than losing money; that’s throwing good money after bad! Even when we know we have made a bad financial decision, we often stick our head in the sand in the hope the losses will miraculously disappear, rather than exit and stop the bleeding. Everyone makes mistakes. Face them, learn from them and move on.

Our fear of loss is instinctive, which makes it very hard to displace. However, to be successful investors we must be aware of how it can cloud our judgment and filter out information which is designed to accentuate this fear, rather than help us make good investment decisions.

If you would like to contact Campbell Korff of Yellow Brick Road Ballina go to: www.ybr.com.au/Branches/Ballina

The post Campbell Korff on why it pays to have your glass half full.. appeared first on .

]]>The post The silver lining in the major bank rate rise appeared first on .

]]>The ‘Big Four’ banks all took the unusual step a couple of weeks ago of raising their mortgage rates by between 0.15 and 0.20% independently of the central bank. While by no means welcome news for homeowners, already nervous about a fragile economy, the rise will have a modest impact given the low base they rose from.

What the rise is really about, is the banks’ need to raise capital to sure up their balance sheets following APRA’s change to its capital adequacy requirements for banks in July this year. Obviously, if you are in the business of selling new shares, it is best to do it at a time when the prospects for future growth in earnings are good. If this is not the case, all you are doing is diluting existing earnings (from which dividends are paid) among more shareholders. The result: a lower share price.

For many reasons the opposite is currently true for the Big Four banks. So demonstrating to the market that they retain pricing power and are able to maintain their earnings, even in an unfavourable environment, will help the sales pitch for their new shares. For the time being at least.

The real winner out of this move is the RBA and, ultimately, the broader economy. Hitherto, the RBA was between a rock and a hard place: it needed to maintain low, possibly lower, interest rates to support a rebalancing of the economy but at the same time take the steam out of an over-heated metropolitan property market. Ongoing constraints in the supply of new homes and limited influence on lending policies, made this task almost impossible.

Fortunately, in an unintended act of altruism, the Big Four have raised rates and signalled that they might do so again. They have also had to, belatedly, tighten their lending to property investors. This has sent buyers in Sydney and Melbourne back to their spreadsheets.

Thus, the way is now clear for the RBA to maintain, if not further reduce, the cash rate to support the services sector and exporters (who will benefit from a resultant lower dollar). All good news for the Northern Rivers economy.

If you want to contact Campbell Korff of Yellow Brick Road Ballina go to: www.ybr.com.au/Branches/Ballina

The post The silver lining in the major bank rate rise appeared first on .

]]>The post Campbell Korff on planning your exit strategy to maximise value appeared first on .

]]>

Small business underpins our economy and provides a source of income and store of wealth for millions of Australians, writes Campbell Korff. This means that those same Australians also rely on the value realised from the sale of their business to support them in retirement – and that can be a problem.

I have discussed previously how not enough small business owners are making use of the huge tax advantages of superannuation during their working lives. All is not lost, however, if you are in this category. The government anticipated this and has provided small business owners with special tax concessions when they sell their business assets at retirement, provided they then make use of superannuation.

What this all means is that it is critical that business owners maximise the value of their businesses when they sell out or retire.

For most, however, this means seeking offers a few months before they need to sell from their own network or possibly getting a local real estate agent to do some advertising. Having negotiated a quick deal with a competitor or staff member, a short meeting with their accountant and solicitor follows to work out the tax bill and contract.

Given most small business owners put their heart and soul into their businesses for most of their lives, this process hardly seems to be doing justice to a life’s work.

Where was the planning? What was the valuation method? What steps did the owner take in the years leading up to exit to maximise that value? Was a sale the best exit or would more value be captured by structuring a succession plan for a promising junior? Were other structures available to entice the buyer to pay more? Was a tax and retirement plan developed beforehand?

Exiting a business successfully is a complex process during which hundreds of thousands of dollars of your wealth can be destroyed if care and, importantly, expert advice is not taken well ahead of time. Indeed, to a certain extent, you should always be buyer ready because you never know when that ‘too good to refuse’ offer might land on your desk.

If you want to contact Campbell Korff of Yellow Brick Road Ballina go to: www.ybr.com.au/Branches/Ballina

The post Campbell Korff on planning your exit strategy to maximise value appeared first on .

]]>The post Win $5000 and a mentoring session with Mark Bouris appeared first on .

]]>

Verandah Promotion

Do you want to meet renowned Australian businessman, media personality, chairman of Yellow Brick Road, and this seasons host of Celebrity Apprentice, Mark Bouris?

Yellow Brick Road Ballina are offering you the chance to meet with Mark Bouris for a one hour mentoring session where you can get Mark’s personal insights into being successful. They are also throwing in a hefty $5,000*

For your chance to win, register with Mark’s trusted advisers at Yellow Brick Road Ballina for an obligation-free 15 minute financial health check.

In your financial health check, your advisor will look at what your financial goals are, where you are now and help to start you on your journey to a secure financial future.

Contact our Ballina branch on 02 6686 6678 for your obligation-free health check and we can get you started on your path to financial freedom.

* Competition Terms and Conditions apply. Credit services provided by Yellow Brick Road Finance Pty Limited ACN 128 708 109, Australian Credit Licence 393195. Financial Planning services provided by Yellow Brick Road Wealth Management Pty Limited ACN 128 650 037, AFSL 323825.

The post Win $5000 and a mentoring session with Mark Bouris appeared first on .

]]>The post Letting go of the past to plan for the future appeared first on .

]]>

If you’ve got an empty nest downsizing the family home is an excellent financial strategy, writes Campbell Korff of Yellow Brick Road.

The current debate (or non-debate, if you happen to be a member of parliament) about the exclusion of the home from the aged pension assets test, is a nettle that I will leave those more politically astute than I to grasp. However, it does raise an important financial planning issue for retirees and empty-nesters.

A neat side effect of the ‘great Australian dream’ is that much of middle Australia reaches their 50s or 60s with little or no mortgage and an empty nest. This presents two very effective financial strategies to lock-in a more comfortable retirement. The first is a ‘Transition to Retirement’ strategy. The second, which we are looking at now, is downsizing the family home to release equity for investment to help fund retirement.

The logic of the latter strategy is quite straight forward: you release capital from an illiquid, non-income producing asset for investment in asset classes with these characteristics, thereby providing a higher and more effective income stream in retirement.

The first step, and possibly the hardest, is to detach emotionally from what may have been the family home for decades. I have seen many clients and friends go through the angst of this decision over months and years, only to come out the other end wondering why they took so long to do it. Each to their own, however. The timing must be right for you and your family.

From a financial perspective, though, it is very much a case of the sooner the better. This is because of compounding and the tax incentives supporting superannuation. In short, the longer your money is working for you in the friendly superannuation tax environment, the greater your retirement wealth will be. After-tax lump sums of between $180,000 and $540,000 (using the ‘bring forward’ rule) from asset sales can be contributed to superannuation in a financial year, provided you are still working.

So as soon as the kids leave home, it is worth developing a downsizing strategy with your financial adviser. For those intending to take advantage of the current aged pension assets test to keep their home, I would strongly recommend a Plan B.

If you want to contact Campbell Korff of Yellow Brick Road Ballina go to: www.ybr.com.au/Branches/Ballina

The post Letting go of the past to plan for the future appeared first on .

]]>The post Asking yourself the uncomfortable ‘what if’ questions appeared first on .

]]>

To protect your family, Campbell Korff from Yellow Brick Road suggests that you ask yourself the uncomfortable ‘what if’ questions.

The life insurance industry has been in the spotlight recently. The commission structures paid to brokers and advisers by insurers have been accused of causing excessive ‘churning’ (moving clients to a new insurer unnecessarily), because a large portion of the commission was paid on issuance of the policy. While the restructuring of these commissions to a longer term and flatter structure was right, in my view, it missed an opportunity to address the much bigger issue of why Australians remain chronically under-insured.

The regulators and insurers only have themselves to blame in this regard. For too long life insurance was ‘sold’ to people using aggressive marketing techniques by networks of agents and thinly qualified advisers rewarded by very large commissions. The innate Aussie suspicion of the salesman and the big institution operated to thwart these efforts and has placed the insurance industry near used cars and real estate as the professions least loved.

The problem is that there is now a huge number of people that live with the risk of being wiped out financially every day but are either totally oblivious to it or choose to ignore it. Others believe they are covered but have inadequate or inappropriate cover.

Personal risk management is a key component of everyone’s financial affairs. It is a complicated area and you should seek expert advice from an independent professional, however, the following summarises some of the key principals:

- Your future income is your biggest asset, so before you insure your boat, car or even your house, insure yourself. Even for people on modest incomes, you may need to invest an insurance lump sum of over $1million to replace your future income.

- Many people think ‘it’ will never happen to them. Google the statistics. Odds are ‘it’ will before you retire. More importantly, think about the downside for your family if ‘it’ does and you are not covered.

- Ask yourself the ‘What if’ questions:

‘What if something happens to my partner’s health and he/she:

- a) dies

- b) can’t work for 6 months

- c) can’t work ever again

- d) needs emergency surgery, how would the family cope financially?’

Make sure your partner does the same.

- There are four types of personal risk insurance: life, total permanent disability, income protection and trauma cover. Each is designed to help you address these ‘What if’ questions. Getting the balance right requires a technical understanding of each and your personal circumstances and risk tolerance. This is your adviser’s job.

- Like most things, with insurance you get what you pay for. If it’s cheap, there’s a reason: it doesn’t cover as much.

- The ‘default’ insurance cover provided with most industry superannuation funds is rarely adequate for a family with children and debt.

- If you have existing insurance, think carefully before switching to a new insurer. If you have suffered health problems or changed your lifestyle, the new insurer may not provide the same breadth of cover as your existing one.

- Always pay your premiums on time and never cancel a policy before a replacement has issued.

If you want to contact Campbell Korff of Yellow Brick Road Ballina go to: www.ybr.com.au/Branches/Ballina

The post Asking yourself the uncomfortable ‘what if’ questions appeared first on .

]]>The post Cash vs Shares – the end of the debate appeared first on .

]]>

As a financial adviser Campbell Korff knows what worries people – they don’t want to risk losing their savings, but he also knows that cash simply doesn’t work as a long term investment. He explains why…

The team at Yellow Brick Road Ballina fields around half a dozen enquires a day from people, predominantly retirees, asking what our best term deposit rate is. Upon further enquiry, it is more often than not revealed that the person enquiring has the bulk of their super and savings in cash because: “I lost a lot in the GFC and want to avoid risk”.

This concerns me so much that I recently invited some leading investment experts to Ballina and Byron Bay to deliver a seminar de-bunking some of the commonly understood concepts of risk and investment. The response was so positive, that I thought I would attempt to summarise the key points in this column.

As a case study, we looked at the relative performance of a $10,000 term deposit invested from 1980 to 2013, compared to the same amount invested for the same period in the entire ASX 200 companies (the good, the bad and the insolvent, across a period which included several crashes and crises).

The key conclusions of our discussion were:

- All of us, including most retirees, are investing our super for 20 years plus: matching your investment strategy to your timeframe is critical;

- Inflation is the enemy of long term investors;

- Because of inflation, cash simply doesn’t work as a long term investment;

- A well-diversified portfolio of shares should be part of all long term investment strategies;

- Re-balance your portfolio regularly to manage risk; and

- Don’t try to time the market: invest a little often and don’t overreact to short term volatility.

If you would like more information on these issues, drop me an email at [email protected].

The post Cash vs Shares – the end of the debate appeared first on .

]]>The post Doing sums to build your wealth appeared first on .

]]>

Pay off your house, or invest in Super? Campbell Korff examines the choices.

What is a better investment – paying off your home mortgage or putting more money into superannuation? It’s an age-old questions writes Campbell Korff, pointing out the advantages – and disadvantages – of each method.

As an investment, paying off your home loan early is very hard to beat. Paying off your mortgage equates to an after tax return on your capital equal to your mortgage interest rate. Even with interest rates down around 5%, to beat it you would have to find an alternative investment which provides a pre-tax net return of more than 8%. This is because you would pay tax on that return at your marginal tax rate. Assuming that to be, say, 34%; you get to keep 5.36% of an 8% return. As mortgage rates increase (which they will), this equation becomes even more compelling in favour of mortgage repayments.

What’s more, your return from home loan repayments is guaranteed (your bank must reduce your loan balance if you make a principal repayment), whereas returns from any other investments are not.

Every time you are able to generate savings for investment, ask yourself which asset classes are capable of beating your mortgage after tax and then ask yourself whether you are comfortable with the level of risk.

Super, on the other hand, is given a substantial leg up courtesy of the tax incentives provided by the Government to get us all to save for our retirement. Not only are contributions from your pre-tax income up to $30,000 ($35,000 if you are over 50) only taxed at 15%, but you get the huge benefit of compounding between now and retirement and your earnings from investments within Super are concessionally taxed. This equation brings a lot more investment options back into the picture versus your home loan repayments.

To illustrate this, I recently put together a financial model for a couple in their mid-forties with stable income from teaching and nursing respectively. They are currently generating a surplus of around $1,500 a month after their living expenses and regular mortgage repayments. The question was: should they invest the $1,500 in Super or prepay their mortgage? Assuming a relatively conservative “balanced” Super investment portfolio of fixed income and shares and their mortgage rate at 5.2%, Super came out over $25,000 in front over 10 years.

As always, everyone’s situation is different and you should ask your financial adviser to do the maths for you and design a plan that fits your circumstances. However, in many cases, salary sacrificing to Super will be very hard to beat.

Campbell Korff is the principal of Yellow Brick Road Wealth Management, Northern Rivers. Email: [email protected] ph: 66876678.

The post Doing sums to build your wealth appeared first on .

]]>