The post Oils ain’t oils and not all managed funds are the same appeared first on .

]]>

The key to managing investment risk, writes Campbell Korff from Yellow Brick Road, is to identify an appropriate investment strategy – and not to tar all mangement funds with the same brush.

Since the global financial crisis, I’ve found many investors in the Northern Rivers very reluctant to consider any investment via a managed fund, regardless of the underlying investment strategy and level of risk. While this is understandable given the difficulties many investors have faced redeeming their investments from mortgage funds, with others forced to freeze redemptions in the aftermath of the Global Financial Crisis, it’s really not rational.

A Managed Investment Trust, to use the technical term, is simply a legal structure used by investment managers to hold assets which they have invested in according to the mandate, or investment strategy, given to them by their investors. So to tar all managed funds with the same brush, is like saying BHP Billiton is a bad company because many companies became bankrupt following the GFC. Obviously, the quality of BHP’s management and business assets got it through the GFC and the same is true of the managed funds that survived.

Many of the funds that didn’t survive may have simply been pursuing high-risk investment strategies to start with, in which case investors got what they paid for; so long as they received proper advice when investing (which, unfortunately, many did not).

Managed funds offer many benefits, such as: greater diversification, professional management, advantages of scale and ease of administration. The sum of which should achieve better long-term net returns than you could investing in the same way yourself. However, this comes at a cost in the form of management and performance fees. These fees should reflect the complexity of the fund’s strategy and long-term performance, which you should always compare net of fees.

They also come with particular risks – principally, manager and liquidity risk. Just like businesses, if management is incompetent or dishonest, funds will fail. Also, redeeming capital from a fund relies on there being sufficient cash available to repay investors. If many investors ask for their money back at once, which is what happened in many cases during the GFC, there may not be enough cash assets available to repay them without damaging the position of all investors, forcing managers to freeze redemptions. This is liquidity risk.

The key to managing these risks is carefully identifying an investment strategy which is appropriate for you, and, if a managed fund is the most efficient way to execute that strategy, finding a fund with a similar investment mandate and, importantly, a manager with a strong long-term track record in successfully executing that strategy. Your financial planner can help you develop your investment strategy and determine if a managed fund is appropriate for you.

If you would like more information on these issues, drop me an email at [email protected]. Or visit the YBR Ballina website on: ybr.com.au/Branches/Ballina

The post Oils ain’t oils and not all managed funds are the same appeared first on .

]]>The post The importance of your credit score appeared first on .

]]>

You might think the ability to pay back debt would the most important criterion for borrowing money, but it’s not the only one, writes Campbell Korff.

A young couple came into the branch in Ballina the other day looking for a loan to finance their first home. After getting a little background on their income and savings, it was clear that their dream of buying a home was attainable financially.

However, ability to repay debt is not the only criteria used by most lenders. Lenders are also concerned to establish that a borrower has the willingness to repay as well. This sounds trite, but what they mean is that the borrower has demonstrated that they are sufficiently diligent and reliable to comply with credit terms over time. These days, this question is often answered by a statistical record known as a credit score.

Unfortunately for the couple in question, despite a clear record as far as defaults are concerned, they failed to reach the benchmark set by the many lenders who credit score. This is because their current bank had regularly offered them increased limits on their credit card as their financial situation improved. Ironically, this proved their undoing, because with each increase the bank lodged a “credit enquiry” on their credit record, negatively impacting their score.

While we were able to place them with a lender who doesn’t credit score, this narrowed significantly the number of lenders available to them and increased their borrowing costs.

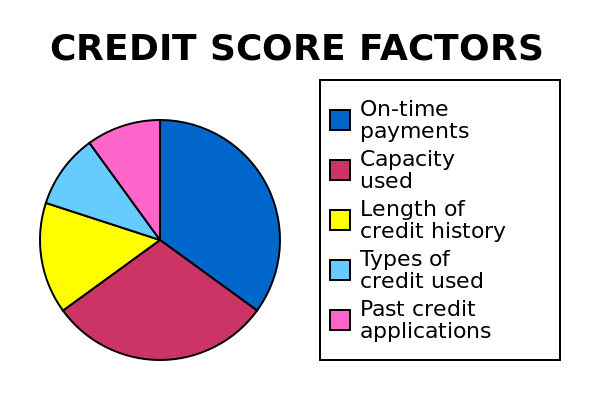

A credit score tracks your application for and repayment of debt. Obvious debt includes a mortgage, car finance and credit card, but phone companies and other utilities also run credit accounts.

“Their banks had offered them increased

limits which proved their undoing…”

A credit reporting agency receives information from finance companies, banks and utilities, and adds it to your credit file. Those things worth reporting include arrears on a bill (usually more than 60 days late), missed loan repayments, new applications for credit, guarantees, litigation, change of job and address and defaults. Most of this information remains on file for around five years.

While an agency collects your credit history and gives you a score, it’s the lender you are dealing with who makes the final decision as to what kind of risk you represent.

There are a few steps people can take:

- Clean up: start by getting your repayments organised for credit cards, bills and loans. You can’t change history but you can influence your financial future.

- Job and house: take the easy points on a credit score and don’t change address or job for a year before applying for a mortgage.

- Applications: try not to apply for unnecessary credit. Typically people that chase zero balance transfer rates and change their credit cards multiple times each year can get scored down, so be careful.

- Get a report: you can go to the web site of a reporting agency such as Veda to access your credit report. Once you know your score – and the reasons for it – you can start planning.

- Broker: some mortgage brokers provide a free credit report because it will help determine which lenders will consider your loan application. If you’re working with a mortgage broker, be sure to ask about this service.

- Build the positive: changes introduced this year mean you get to build a score on positive credit behaviour. This means that every on time repayment is a small positive mark on your credit file. It’s worth thinking about how to take advantage of this.

Credit reports are a fact of life if you want to borrow money – they can be really helpful, so learn how they work and start planning. Good luck.

The post The importance of your credit score appeared first on .

]]>The post Take his advice: keeping your wealth healthy appeared first on .

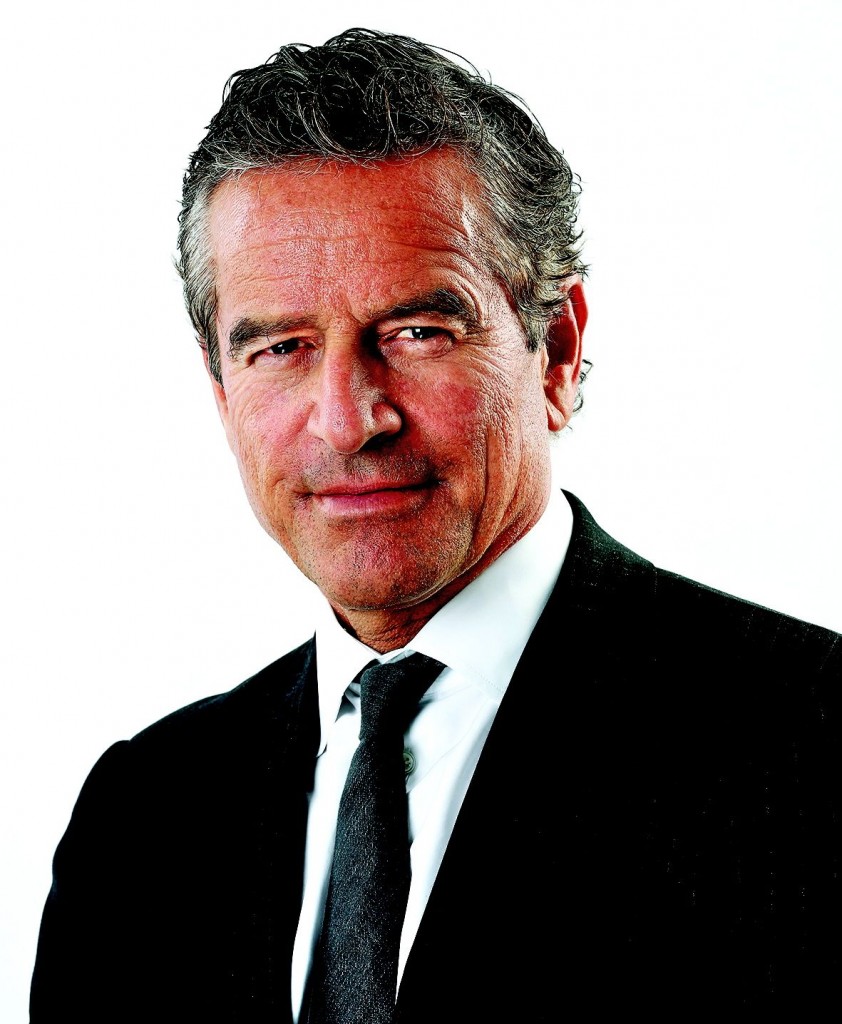

]]>Mark Bouris is no stranger to wealth creation – after all he’s the man who’s best known as the founder of Wizard Home Loans. He’s also no stranger to Byron Bay, and is actively involved in the local community. Bouris is currently the Executive Chairman of Yellow Brick Road, a wealth management company whose goal is to give families and small businesses access to quality financial advice. Next Saturday August 16, you can go into your local YBR office and get some sound financial advice for free.

It’s easy to look at a financial system and ask the government to make it fair. But what if our system was fair? What if the laws and regulations provided for an even playing field so everyone had an opportunity to build financial security for their family and create wealth for retirement?

Many people will tell you that Australia is indeed a land of equal opportunity. If this is the case, the responsibility is not only on the government to ensure we build private wealth, but on ourselves.

Lately I’ve written about the need for financial education in our schools, but we also have to educate ourselves as adults. Among other things, I’d like to see more people using advisers to make financial decisions.

Most working-age Australians do not use advisers, even though they are contributing to a mandatory superannuation system that puts a percentage of their earnings into a range of investments.

Research over the years shows us that no more than 40 per cent of Australians use financial advisers on more than a one-off basis. This is low when you consider that individuals really should carry the responsibility of funding their own retirements.

Advisers usually produce greater wealth for clients. KPMG Econtech’s 2009 survey found that Australians with advisers would save more than $1500 per year more than those without advisers. A person with an adviser, if they started at age 30, would be at least $90,000 better off by age 65 than a person who was not advised. Those with an adviser had more life insurance and Total & Permanent Disablement insurance than those without an adviser.

The Australian Securities & Investments Commission (ASIC) goes further. In its 2010 report into financial advisers, ASIC says access to quality financial advice is part of “confident and informed participation by Australians in the financial system.”

I agree with this assessment. I worry about uninformed Australians who lack the confidence for making decisions about investments, mortgages, insurance, superannuation and tax issues without expert advice.

There have been a few ideas floated on how to lift the use of financial advisers. One could be to make financial adviser fees tax deductible to a certain level. Another allowed advisers to give low-cost, basic advice. As far back as 2009 super fund trustees were allowed to give what they call intra-fund advice – financial advice to their own members.

Many fund managers have tried to introduce their members to the concept of advice.

My company is going one step further by launching an “Ask My Advice” Day in which our branches will open their doors for the day next Saturday the 16th of August, 2014, so anyone can come in and ask their questions and get some advice for free. It’s in response to people telling me that they don’t take advice because of deep-seated concerns about cost, scale, mistrust and access, and the issue that hangs over the entire discussion: the lack of financial literacy.

So, this won’t be resolved on one day, but we can make a start and make Australians more informed and confident in their financial decisions. I’d love to hear your thoughts.

Mark Bouris

The post Take his advice: keeping your wealth healthy appeared first on .

]]>